How To Launch and Grow Your Planned Giving Program

Have you been putting off organizing your planned giving program because it feels complicated or overwhelming? With so many options and types of programs, it’s understandable! Fortunately, your organization can start as small and simple as possible and scale as you grow.

Also known as legacy giving, planned giving lets donors support your organization with a gift arranged in advance but not given immediately. Most often, planned giving occurs through a trust or a will and is granted after a donor’s death.

Because not all donors can make a large immediate or outright gift, having a planned giving program can help you convert small but loyal donors into major donors in the future.

Let’s take a deeper dive into how your charitable organization can boost your long-term fundraising efforts. Our guide will help you identify potential legacy donors, empower your board members, and ensure your donors are aware of their planned giving options.

How Planned Giving Works

If you’ve been shying away from forming a planned giving strategy for your organization because it feels overly complicated, rest assured that you can adopt a plan that is as simple or complex as needed for your organization.

While most planned gifts come from simple bequests, which we’ll explain further below, there are some other common forms of planned giving. Here’s a list so you can sound like an expert when speaking to your potential donors about your program and their options.

Bequest

A bequest is a simple and popular form of planned giving. Your donors would indicate how much of their estate they would like to be allocated to your organization in their legal will.

Charitable Lead Trust

A charitable lead trust is an irrevocable trust, which is a type of trust that cannot be modified after it’s been established. Donors can support one or multiple charities through a charitable lead trust. The designated charity begins receiving regular income from the trust when it’s formed, and after a set period of time, the remainder of the trust goes to the donor’s specified loved ones.

Unitrust

A unitrust lets a donor provide a source of income for the named beneficiary during the donor’s lifetime. The remainder of the trust balance would typically go to a charitable cause after death.

Charitable Remainder Trust

A charitable remainder trust is a tax-exempt trust that lets a donor reduce their taxable income by distributing earnings to designated beneficiaries and themselves over time.

Charitable Gift Annuities

A charitable gift annuity lets your donor make a gift to a charity of their choice, and the donor receives a fixed dollar amount for life in exchange. Donors may receive a tax deduction, and upon the donors’ death, the remaining funds stay with the nonprofit organization.

Identify Planned Giving Prospects

Once you’ve decided to start promoting planned giving, you’ll want to identify your strongest prospects. You may uncover opportunities naturally through the relationship-building process as part of your donor cultivation or stewardship activities. Some organizations opt to include a checkbox on their donation form that lets donors indicate their interest.

However, you may be able to tap into your donor management software to identify other opportunities. Take a look at the characteristics of your donors to see who might be a good fit.

Here are a few identifying qualities to look for:

- Length of giving: Take a look at how long your donors have given and highlight any that have given for five or more years. Even if there were skipped years, the history shows a commitment.

- Current volunteers: Individuals who volunteer their time or services are just as likely to be interested in planned giving options as those identified as major donors or labeled as high wealth.

- Frequency of giving: Individuals who donate frequently are also likely candidates. Take a look at your donors who contribute monthly and donors who give more than once a year.

- Family associations: Donors who have a family relation or ties to your organization could also be marked as potential planned giving donors. Beneficiaries included!

- Few remaining obligations: Look for donors with few familial or other obligations remaining after they pass. Donors who have no mortgage, debt, or heirs should be considered strong candidates.

- Retired comfortably: Highlight donors who are retired or nearing retirement age and have a comfortable future financial situation.

Involve Board Members

Once you’ve decided which planned giving vehicles your organization will work with, you can kickstart your program by getting your board members involved. While board members may be hesitant to help out with direct asks, there are lots of ways they can still be involved in your planned giving strategy.

Have Them Lead by Example

Your board members provide direct community contact and presence. Often well known and highly respected in your local community, board members can help your organization get your planned giving program off the ground by making their own planned gifts. Your donors, prospective and current, will be more inclined to support a program they see already has some substance.

Have Them Educate Donors

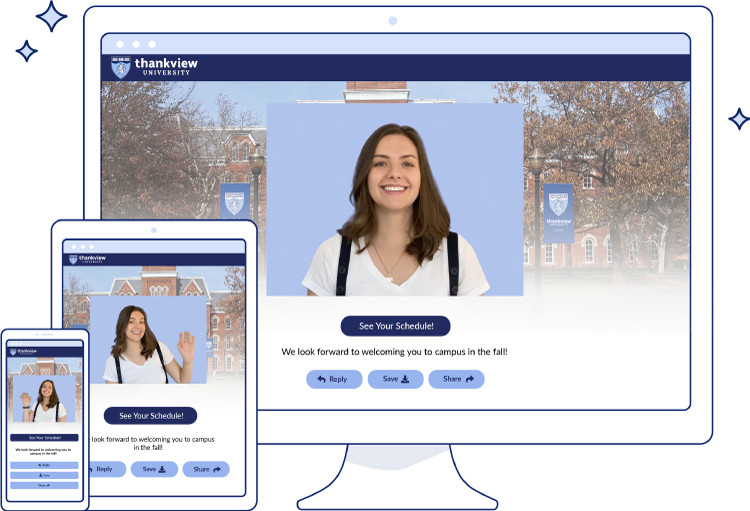

The ins and outs of legacy gifts can be confusing for organizations, which may be no different for your donors. You can ask your board members to record informational videos describing how the process works and how your organization handles the details. With ThankView, you can not only personalize but email or text the videos directly to the recipient. Board members can then invite the recipient to respond back to them, also through video, with any questions!

Have Them Act as Stewards

You can incorporate your board members into your donor stewardship plan by designating them as planned giving stewards when a donor includes your organization in their estate plans. These donors deserve to be recognized and appreciated during their lifetime. Using board members to stay in touch with your planned giving donors can be an effective way to show gratitude. Board members can record and send personalized video messages for birthdays, anniversaries, and of course — expressing gratitude.

Promote Your Planned Giving Program

Though you’ll rely on your board members to lead by example and educate the community about your program, you’ll still need marketing to be successful. Only 37% of donors older than 30 recognize the phrase “planned giving”! With a creative and personalized approach to your marketing, you can be sure every prospective donor is aware of their options.

Mention Planned Giving in all Regular Communications

Consistency is critical with planned giving asks — this is a longer cultivation process than traditional immediate requests. You can reinforce the message by including it in all regular communications. Whether it’s direct mail pieces or your regularly scheduled newsletter, the more often your viewers see it mentioned, the more comfortable the conversation can become.

ThankView users can easily send emails that include two separate videos with our video sequencing feature. Your organization could use this to add a video from a current legacy donor sharing why they’ve chosen to support your organization in their trust planning. It can be easily added on to regularly scheduled video communications.

Schedule In-Person Meetings

Face time with your prospective donors can show them how seriously you consider your organization in their estate planning. Face-to-face meetings can help your donors feel more comfortable asking questions about gift planning and charitable bequests.

These meetings may be the best platform for more detailed questions about the donor and your organization. Donors may have questions about your intended use for their gift, tax-related questions, or what benefits would be extended to them during their lifetime. You can share the details of how your donors’ support would specifically aid your organization.

Brand Your Legacy Program

Most organizations only use the term “planned giving” for internal purposes. Generally, when promoting their program, organizations will refer to it as something like “The Legacy Society” or “Legacy Program.” You can take it a step further by branding your entire program.

Creating a sub-brand that promotes your legacy program is a great way to speak more clearly to your intended audience. While most of your communications around fundraising will involve immediate asks and needs, this will be an entirely different ask needing another message from your organization. You can adopt a specific logo and unique name for your legacy program brand to showcase the opportunity.

Plan Out Your Planned Giving

With so many deserving nonprofit organizations needing support, you can stand out with personalized video messages. Book a demo with our team today to see how our personalized video platform can make your program memorable and rewarding.