How To Start a Nonprofit Organization the Smart Way

Have a burning desire to launch a nonprofit? It’s always exciting to see new projects launch and new teams committing to do good in the world around us. But how do you take your idea and make it reality?

Here’s how to start a nonprofit organization — with all the details you need, and none of the fluff that you don’t.

1. Do Your Research

You might be wondering how to start a nonprofit organization, but it makes sense to do research first. It’s a big step, and one that will be challenging, so you want to know that it’s definitely the right decision.

Is There a Need?

Take a look at the world around you. Recent figures show that there are over 1.6 million nonprofits registered in the United States.

This means that despite your goals, your nonprofit startup might be in a niche that’s already covered. Taking the time to research your market, audience, and needs in your local area can help you avoid this.

Start by running a few Google searches to see what’s around in your area. Look through news articles and ask around to build up an idea of whether your idea would work or whether it’s already being covered. You’ll also find a pretty comprehensive list of nonprofits in this nonprofit directory.

Is there another nonprofit or charitable group that’s tackling the same issue as you, or even something similar? If so, it might make more sense to combine forces and collaborate instead of starting something new. This is especially true in high demand areas like animal shelters.

If you see a gap in the market, think about whether your proposed nonprofit can fill the need. Maybe you offer a similar service to another group but it’s aimed at a very specific audience. You might even have a completely new idea for a program, service, or opportunity that’s missing from your local area.

Different Types of Nonprofits

Chances are you already have a good idea of the cause you want to support and how you want your nonprofit to look. Most nonprofits are classified as public charities within the 501(c)(3) charitable organizations classification, but did you know there are other options too?

If you offer a specialist service or serve a specific group of users, you may find your nonprofit falls into another category of tax-exempt organizations. Here are a few examples:

- Trade or professional associations

- Social clubs

- Cemetery companies

- Veterans organizations

- Religious associations

It’s worth checking out the list of tax exempt organizations from the Internal Revenue Service (IRS) to see which classification your nonprofit is likely to fall under. This will help when it comes to later stages like incorporation and filing for tax-exempt status.

Why Start a Nonprofit?

If you’re not sure how to start a nonprofit organization, the process can be tough. There’s a lot of paperwork and compliance that comes with it. This means it’s not for everyone, but there are benefits — especially when it comes to making an impact with your funds.

Most nonprofits are eligible for tax-exempt status, meaning they pay no tax to the IRS. Your profits all go back into running the organization, so none of those vital funds go to waste. You’ll also be able to raise funds for your cause and apply for grants from government organizations and corporate sponsors. Without that all-important nonprofit status, this isn’t possible.

What Are the Alternatives?

You might have a great idea for a new way to support your local community or a cause close to your heart, but decide that a nonprofit isn’t for you. There are alternatives that allow you to make a positive impact within the nonprofit sector:

- Keep things simple by registering a for-profit business instead, and consider donating a percentage of your profit to charity.

- Set up initiatives like volunteer drives, contribute products in kind, or sponsor a cause.

- Become a board member or volunteer for another nonprofit corporation.

2. Get Planning

At the heart of most successful businesses is a plan. While nonprofits are often born out of a passion to do good, they still need to cover basic needs like bringing in revenue and reaching the right people. Get a head start on success with a strong business plan, marketing plan, and donor engagement plan.

Write a Business Plan

When you start a business, people will often suggest you write a business plan that details your aims, vision, goals, and how you’ll get there. The same approach works for nonprofits, too.

There are a few sections you’ll want to cover in your business plan. These include:

- Executive summary. Here you’ll write a summary of your business plan. It should be short and sweet and let the reader get a feel for your plans in just a few sentences.

- Vision, mission statement, and core values. This is where you set out your ideas, goals, and what drives you. Create a list of core values that speak to you and how you work. Think about the impact you’d like to make and how you’ll make that a reality.

- Programs, services, and products. Create a list of the different elements you’re going to offer to your audience. This could include membership programs, events, merchandise, and more. Chances are this’ll grow and change as your nonprofit forms, but it’s good to have an idea in mind.

- Analysis. This section is where you show you have an understanding of what the nonprofit landscape looks like. Include analysis of similar nonprofits, stakeholders, and what makes your nonprofit stand out.

- Marketing plan. Here’s where you get into a little more detail about how you’ll spread the word about what you do. Think about your customers and who they are, where they spend time, and what they need. Consider different marketing channels like your website, social media, events, and ambassador programs. Bring it all together into a simple plan that outlines how you’ll tell people you exist.

- Operational plan. Consider all the operational essentials you need to run your nonprofit. This could include your organizational structure, your office space needs, and where you’ll source supplies.

- Financial plan. Keeping your finances in check is essential when you’re running an organization. Think about how much income you’ll need, where it’ll come from, and how you’ll manage costs.

For a more detailed look at how to write your business plan, take a look at this business planning for nonprofits template.

Think About Your Donor Engagement Strategy

It might seem early to be thinking about donor engagement, but it doesn’t hurt to have some idea in place. Your donors and supporters are likely to be the lifeblood of your nonprofit, so it pays to make sure you know how to reach them.

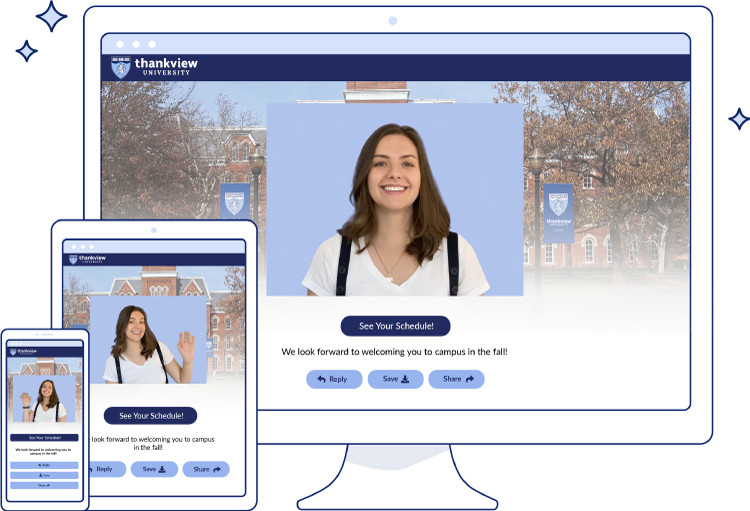

Consider different ways you can reach, engage with, and encourage donations from people. This might be through building a strong ambassador program, or by running livestreams on social media. Think about how you can go the extra mile and create loyal supporters — for example, by sending personalized thank you videos. Start thinking about your donor engagement plans now so you’re ready to go when you launch.

3. Hire Your Team

Every great nonprofit needs an inspiring, talented, and motivated team. Start building the foundations of yours by recruiting a superstar board of directors.

As the founder, you can sit on the board and act in one of the required roles. These include a president, treasurer, or secretary. To fill the other roles, you’ll need to bring a few lucky people along with you for the ride.

Governing vs. Working Boards

Start by figuring out whether you want a working or governing board.

The difference between the two is that with a working board, your directors are carrying out the activities of your nonprofit. This means you don’t need a paid team to get the job done.

A governing board gives your board members more of a leadership role, with you hiring people to take care of the day-to-day nonprofit activities.

If you’re low on funds and have a dedicated team, a working board may be the way to start.

Finding the Best Team

Finding the right people to join your nonprofit board can be tricky. You’ll want executive directors who are genuinely passionate about what you believe in. They also need to bring something to the table — whether that’s talent, experience, or connections. You also don’t want any conflicts of interest from other commitments or family ties.

The hardest thing is finding people that have enough time to dedicate to the work. Being part of a new nonprofit can mean long hours and a lot of working things out along the way. If you have people interested that can’t spare the time, suggest they might like to volunteer at an event or offer support in another way instead.

4. Incorporate

You have a solid idea of what you want to achieve and a team that’ll help you do it. Now it’s time to incorporate your nonprofit and make it official.

There’s a really useful list on the USA.gov website that takes you through the steps to incorporate. In a nutshell, you need to:

- Choose a business name. This should be something unique, so make sure you check that your planned name isn’t too similar to another nonprofit. There may also be laws around naming nonprofits in your state, so check with government officials before you finalize it.

- Appoint a board of directors. You’ve figured out who you’d like to have on your team, so now you just need to make it official. It’s also time to draft your bylaws and the operating rules for your organization.

- Decide on a legal structure. You’ll need to confirm whether your nonprofit will be a trust, corporation, or association. There are some subtle differences between each, so it may be best to consult an expert for legal advice.

- File your incorporation paperwork. Here’s where you’ll fill in the articles of incorporation and send the paperwork to your state. This document features key information about your nonprofit, including name, address, names of directors, and your statement of purpose. To find out which state office you need to file with, head to the National Association of State Charity Officials (NASCO).

- Obtain any relevant licenses or permits. Some nonprofits will need extra licenses or permits to legally operate in their state. This often applies to nonprofits that work with the transport of animals or maritime activities.

It’s also helpful to know that you’ll need to budget some funds here to incorporate. Costs vary by state — see this list of incorporation fees by state to see what yours will cost.

While you’re incorporating, it’s a good idea to make sure you’re all set when it comes to soliciting donations too. In many states you’ll need to register to do this, so fill in your Charitable Solicitation Registration nice and early to avoid any delays and stay compliant. You’ll also need to set up your Employer Identification Number (EIN).

5. File for Tax-Exempt Status

After you’ve incorporated, it’s time to file for tax exemption. Once you’re a fully fledged tax-exempt nonprofit under the 501(c)(3) classification, you’ll no longer have to pay federal taxes (like federal income tax and property tax) and will be eligible for state tax exemptions.

To register your nonprofit under section 501(c)(3) of the Internal Revenue Code, you’ll need to fill in a fairly substantial form called IRS Form 1023. If you’re lucky, you’ll be eligible to fill in an expedited version of the form instead, known as IRS Form 1023-EZ.

Check your eligibility for the shortened form on the IRS website and save yourself hours of time. Not only that, but eligible nonprofits can save money on the application fee. Form 1023-EZ has a filing fee of just $275 compared to Form 1023’s $600.

When you’re ready to submit your documents, you can apply for tax-exempt status here. It can take some time to get a decision back from the IRS. This can be anywhere between a few months to a year in some cases, and depends on whether they need extra details from you to make a decision.

6. Launch Your Nonprofit

Once you’ve had confirmation from the IRS that you’re now classified as a tax-exempt nonprofit, it’s time to launch. Review your business plan, marketing plan, and donor engagement strategy to make sure you have everything in place to start on the right foot.

Bring all your great plans and ideas to life and spread the word about your new nonprofit to your local community, press, and potential sponsors. Host fundraisers, create an attractive website, and offer plenty of ways for your supporters to get involved and raise money.

7. Stay Compliant

With your nonprofit up and running, most of the paperwork is behind you — phew. There are a few ongoing compliance needs though, so it’s a good idea to know about them now.

The main thing you’ll want to do is make sure you submit your 990 Form each year. This means you keep your tax-exempt status, so add a reminder so you don’t miss it. It’s a simple form that shares basic information about how your nonprofit is running with the IRS — like how much revenue you’ve made and what your expenses were.

You’ll also want to make sure things run smoothly with your operations. Keep detailed notes of board meetings, stick to your rules, and make sure everyone is acting in your nonprofit’s best interests.

How to Start a Nonprofit Organization the Smart Way

Now that you know how to start a nonprofit organization, what’s holding you back? It’s time to take your plans and make them happen.

Do your research, develop a strategy, and get the legal side of things sorted. Then you’re free to launch, attract donors, and bring your goals to life. If you’d like a helping hand in transforming your donors into loyal supporters, book a demo to find out how our personalized video platform can help.