Easy Steps To Create a Tax-Compliant Donation Receipt

Having a tax-compliant donation receipt is both simple and complicated for nonprofit organizations. It’s simple because at its core, you just need to acknowledge the gift. It’s complicated because the IRS has many legal requirements depending on the charitable donation.

Let’s break down the nuances so that you can create a donation receipt for your nonprofit that checks the boxes for all your donor acknowledgement and recordkeeping needs.

The Basics of Donor Acknowledgement

Fundraising is all about donor stewardship. One way to make donors feel seen and appreciated is to send a heartfelt donor acknowledgement email or letter. This is a written way to thank your donors for their charitable gift.

Sending donation receipts is also a good excuse to stay top of mind with your donors. Be sure your communication is consistent and recognizable in branding and voice. You want the donor experience to be entirely seamless from when they first hear about your cause to your acknowledgement of their gift.

This consistency will give your donors confidence and make them more likely to spread the word organically, as well as come back for future donation appeals.

What To Include in Your Donor Acknowledgement

First and foremost, say thank you. Each of your donors take you one step closer to realizing your mission and vision. You can’t do your important work without their support. Make sure they know this!

Second, donor acknowledgement is a wonderful opportunity to show the type of impact their donation may have and tell stories from previous program successes. Including these stories — and especially photos — will help donors feel connected to your mission and make their contribution more tangible.

A thank you message also provides them with memorable anecdotes so that they can advocate within their networks on your behalf. Peers influencing peers to give to your nonprofit is so much more powerful and effective than even the best cold calls from your development director or paid social media ads.

Next, be sure to formally cite the donation amount, thereby providing a tax deduction opportunity to your donor. However, beware of stating whether or not the gift will be tax deductible. This eligibility varies by state, country, and ever-changing laws. Whether or not the donor is an individual or business might also affect how the deduction is counted (or not).

Your responsibility as the nonprofit organization is to provide proof of receipt. Their responsibility as the donor is to handle their own taxes when tax season arrives.

Lastly, consider who is sending the acknowledgement and thanking the donor. Is it your executive director, the fundraising team member who brought this donor into the fold, or a specific board member? The more personal and tailored to each donor, the better.

Fundraising, especially for long-term sustainability and nailing down larger amounts, is all about relationship building. Yes, your nonprofit is an entity, but it’s made up of living, breathing people who have networks full of other people. Leverage that human side of your organization.

How Donation Receipts Work

Beyond a basic thank you, certain elements need to be included in every receipt in order for your donor to claim that deduction on their individual income tax return. The format doesn’t matter, but the content does. Most organizations send a simple letter and formalized receipt by mail or as a PDF via email.

If you collect your donations online, that makes the acknowledgement process even smoother. Your online donation platform or software might even come with a donation receipt template and allow for automation. Take advantage of these features.

Not only will this save your development staff time and frustration, it might also reduce human error. The last thing you want is to re-issue receipts, track down months-old checks, or have any discrepancies in your own financial reporting.

When a Donation Receipt Is Needed

For tax-exempt organizations in the United States, you need to provide donation receipts to your donors. You should be doing this for everyone, but certain cases are required by law:

- Tax returns for your donors: For anyone who wants to claim their charitable contribution on their federal income tax return, they need to have a bank record or written communication from the charity they gave to. This holds true for any amount of cash.

- More than $250: For donors who give $250 or more in a single contribution, they need written acknowledgement for their tax deduction claim.

- More than $75 in quid pro quo contributions: For tax purposes, it’s required for charitable organizations to send written acknowledgement to a donor who gave a quid pro quo contribution greater than $75. A quid pro quo payment means that the donor partially received goods or services from the charity in return for their contribution. For example, if the donor bought tickets to a fundraising event for $125, $60 of the cash contribution might have paid for the event production, food, and entertainment, while the remaining amount was a charitable donation.

It’s best practice for a nonprofit to send these donation receipts to all their donors. Most nonprofits send their donation receipts at the end of the year or by January 31 of the following year, regardless of the date of the donation. However, it’s much more manageable — and considerate — to send tax receipts right after receiving the donation.

What To Include in a Donation Receipt

Now for the nitty gritty details. While the list is a bit long, most of these elements are common sense. You want to be tax compliant for your own sake and for the sake of your donors.

- Your organization’s name

- The name of the donor

- Your nonprofit’s EIN to share your tax-exempt status

- Your organization’s address

- The donation details:

- The date the donation was received

- The amount of money received (via cash, check, credit card, or payroll deduction) or a description of the in-kind (non-cash) donation

- Confirmation that no goods or services were provided by the organization in exchange for the contribution

- If goods or services were provided, offer a brief description and a “good-faith estimate of the value.” These relate to the “quid pro quo contributions” from above. You can also state that the returns were “insubstantial token amounts” in the form of a T-shirt or desk decoration “freebie.”

- If a religious organization received the donation, provide a statement that “intangible religious benefits” were provided, but these have no tax-related monetary value.

Acknowledgement for Donor Retention

Thanking your generous contributors is a key part of the fundraising process and strategy. Remember, one of the main reasons donors give — besides your life-changing mission and their own goodwill — is because it’s tax deductible. But without a written acknowledgment, your donors can’t claim the tax deduction from donating to your organization.

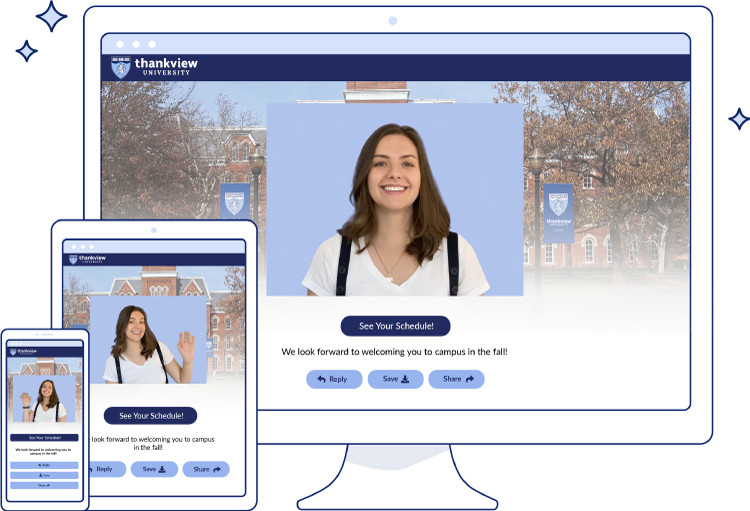

To go a step above, accompany your written donation receipt with a personalized video that automatically includes the donor’s name. The ThankView video platform makes it easy to engage your audience as you raise awareness and funds. Sign up for a demo to see how to turn first-time donors into lifetime supporters.